Free Budget Sheet Template How to Make a Budget Spreadsheet. Select a budget tracker printable from the selection below. There are many different formats and layouts. Select one that is closest to the format you want. Each budget spreadsheet template is totally customizable and editable. If you found everything you want then you can stop here. For general use, try a wheel budget template. One of the more visual budgeting templates, the budget wheel is a fun way to see where your money goes. Every Excel budget template incorporates spreadsheet functionality, graphs, and customizable styles. Download a free budget template so you’ll always know your current financial standing. Home Budget Sheet Template Free And Household Budget Template Mac Excel can be beneficial inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we've been displayed in this site will inspire you all. My Budget Free is the free version of the highly successful and top ranked My Budget app. My Budget is an easy solution to balance your accounts, track your expenditure, and manage your money and more. As a personal finance application one can enter receipts, assign each transaction to a category and to an account.

Kimberly Steinhoff December 4, 2019 FamilyBudget

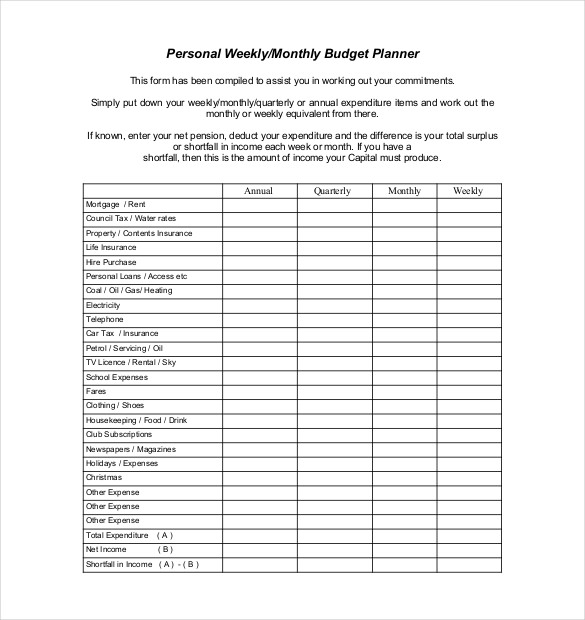

Capital Expenditure Budget Template for Mac Free Download tresor.gouv.qc.ca If there is a need of capital expenditure in any company then budget will be developed for proper expenditure planning. Budget needs tobe very accurate.

Good family budget software will help you learn when to make these right decisions to secure your family`s financial security. There is one program that emphasizes not spending more than what you earned in the previous month, and also to put every dollar to work in some capacity. This makes a lot of sense and it is no wonder why this program has become so popular.

A great point about budgeting is you simply will have to make your family budget once and then it just infrequently has to be altered or readjusted. Budgeting definitely is often really basic to get in place. The only point that causes it to be tough is really a lack of discipline. You must benefit from a household budget template which demonstrates to you how to save money, a great deal of which can be attained on the web.

Family Financial Planning And Budgeting. Families should plan in advance how much they may spend during the following 2 to 5 years in line with their expected family income during that period. In doing this, they should make allowance for any shortfall in their expected family money in that period. They should also put together their expected expenses in the coming 12 months matching it with their expected family money they will receive in that period making sure they will not spend more than they would receive.

Engage your immediate family - spouse and children into the budget project. If you are single then perhaps you`d like to involve your Mom, Dad or a trusted friend - this is to engage you with 100% of your attention on the project as it can be easy to laps back into old habits when doing this kind of thing on your own. With your spouse and children, make your financial budget project into a joint venture, with everyone participating.

Household Budget Management

Oct 01, 2020Weekly Household Budget Sheet

Oct 13, 2020Family Budget Planning Sheet

Dec 09, 2019Printable Easy Budget Log

Oct 15, 2020Displaying anticipated income and expenses allows for a prioritization of expenses, like making mortgage or loan payments before spending money on entertainment and travel. A projected budget provides a framework for making decisions about expenses, such as cancelling premium cable services or to saving money for a new auto-mobile. A budget allows you to monitor how close you are to your goals. This knowledge can help you to create budget plans that connect with your daily habits.

During the family discussion take notes - this is an important discussion and your notes will help to develop your joint family budget. It is important that family members collectively do their part in both understanding the financial situation your family is experiencing as well as understanding that the family as a whole is better equipped to find the solution when working together in the same direction.

Photos of Family Budget Planner For Mac Free

RELATED ARTICLES

Weekly Household Budget Sheet

Oct 13, 2020Xls Family Budget Template Excel

Dec 09, 2019Household Budget Tracking Spreadsheet

Oct 07, 2020